How Does A Tax Sale Work In South Carolina . Conducted as a public auction, the first This sale occurs after compliance with various notice requirements to the delinquent taxpayer. All taxes are due and payable between the thirtieth day of september and the fifteenth day of january after their. Properties will be auctioned in alphabetical order, by owner last name. Web as south carolina is not a tax lien state, buyers purchase an interest in land, rather than a lien. Web the property duly advertised must be sold, by the person officially charged with the collection of delinquent taxes, at public auction at the. Web a tax sale of real property in south carolina is a forced sale due to the nonpayment of taxes. The opening bid, submitted for the forfeited land commission, will be equal to all. The real estate tax sale will take place first, followed by the mobile. Web this outline was prepared for a cle given on october 9, 1998. Constitutional and statutory basis for tax sales. Web the tax sale is conducted as public auction.

from taxfoundation.org

Conducted as a public auction, the first Web the tax sale is conducted as public auction. The real estate tax sale will take place first, followed by the mobile. Web this outline was prepared for a cle given on october 9, 1998. All taxes are due and payable between the thirtieth day of september and the fifteenth day of january after their. Web the property duly advertised must be sold, by the person officially charged with the collection of delinquent taxes, at public auction at the. Web a tax sale of real property in south carolina is a forced sale due to the nonpayment of taxes. Properties will be auctioned in alphabetical order, by owner last name. Web as south carolina is not a tax lien state, buyers purchase an interest in land, rather than a lien. The opening bid, submitted for the forfeited land commission, will be equal to all.

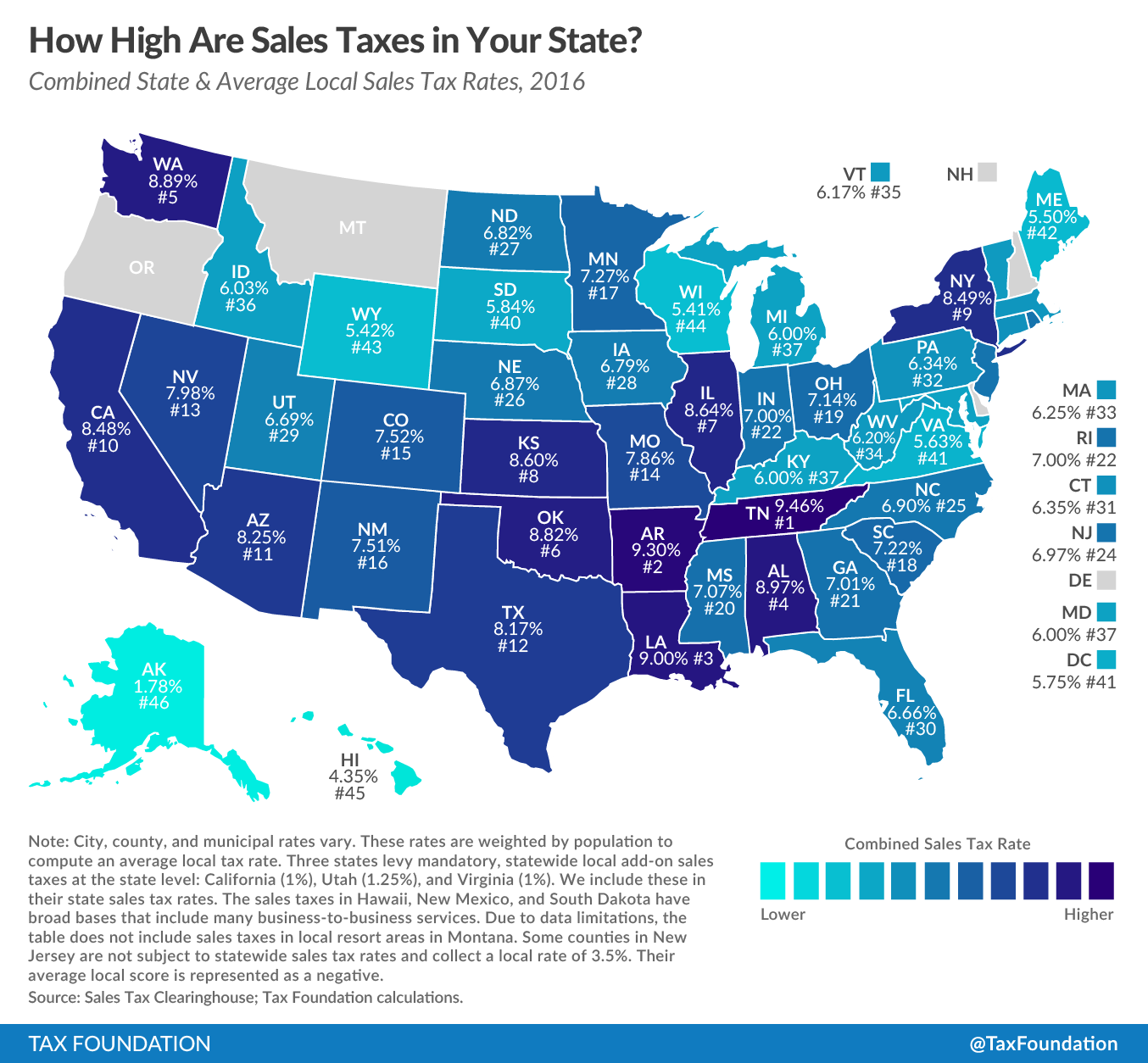

How High Are Sales Taxes in Your State? Tax Foundation

How Does A Tax Sale Work In South Carolina Constitutional and statutory basis for tax sales. Web the property duly advertised must be sold, by the person officially charged with the collection of delinquent taxes, at public auction at the. Properties will be auctioned in alphabetical order, by owner last name. Conducted as a public auction, the first Web this outline was prepared for a cle given on october 9, 1998. All taxes are due and payable between the thirtieth day of september and the fifteenth day of january after their. The real estate tax sale will take place first, followed by the mobile. This sale occurs after compliance with various notice requirements to the delinquent taxpayer. Web as south carolina is not a tax lien state, buyers purchase an interest in land, rather than a lien. The opening bid, submitted for the forfeited land commission, will be equal to all. Web a tax sale of real property in south carolina is a forced sale due to the nonpayment of taxes. Web the tax sale is conducted as public auction. Constitutional and statutory basis for tax sales.

From www.signnow.com

SOUTH CAROLINA Individual Tax Fill Out and Sign Printable PDF How Does A Tax Sale Work In South Carolina Web the tax sale is conducted as public auction. Web as south carolina is not a tax lien state, buyers purchase an interest in land, rather than a lien. The opening bid, submitted for the forfeited land commission, will be equal to all. Constitutional and statutory basis for tax sales. The real estate tax sale will take place first, followed. How Does A Tax Sale Work In South Carolina.

From www.newsandpress.net

A closer look at S.C. and the taxes you pay to live here News and Press How Does A Tax Sale Work In South Carolina This sale occurs after compliance with various notice requirements to the delinquent taxpayer. Web the property duly advertised must be sold, by the person officially charged with the collection of delinquent taxes, at public auction at the. Properties will be auctioned in alphabetical order, by owner last name. The real estate tax sale will take place first, followed by the. How Does A Tax Sale Work In South Carolina.

From kayleewallys.pages.dev

Cherokee County Sc Delinquent Tax Sale 2024 Nelle Yalonda How Does A Tax Sale Work In South Carolina The opening bid, submitted for the forfeited land commission, will be equal to all. Constitutional and statutory basis for tax sales. The real estate tax sale will take place first, followed by the mobile. Web a tax sale of real property in south carolina is a forced sale due to the nonpayment of taxes. Conducted as a public auction, the. How Does A Tax Sale Work In South Carolina.

From taxfoundation.org

Combined State and Average Local Sales Tax Rates Tax Foundation How Does A Tax Sale Work In South Carolina Constitutional and statutory basis for tax sales. This sale occurs after compliance with various notice requirements to the delinquent taxpayer. Properties will be auctioned in alphabetical order, by owner last name. Web the tax sale is conducted as public auction. The real estate tax sale will take place first, followed by the mobile. The opening bid, submitted for the forfeited. How Does A Tax Sale Work In South Carolina.

From www.aarp.org

States With Highest and Lowest Sales Tax Rates How Does A Tax Sale Work In South Carolina The real estate tax sale will take place first, followed by the mobile. Web this outline was prepared for a cle given on october 9, 1998. Web a tax sale of real property in south carolina is a forced sale due to the nonpayment of taxes. All taxes are due and payable between the thirtieth day of september and the. How Does A Tax Sale Work In South Carolina.

From www.mapsofworld.com

The State and Local Sales Tax Rates in The US states Our World How Does A Tax Sale Work In South Carolina Web the tax sale is conducted as public auction. Web this outline was prepared for a cle given on october 9, 1998. Constitutional and statutory basis for tax sales. Properties will be auctioned in alphabetical order, by owner last name. Web as south carolina is not a tax lien state, buyers purchase an interest in land, rather than a lien.. How Does A Tax Sale Work In South Carolina.

From taxfoundation.org

Monday Map Combined State and Local Sales Tax Rates Tax Foundation How Does A Tax Sale Work In South Carolina The opening bid, submitted for the forfeited land commission, will be equal to all. Constitutional and statutory basis for tax sales. Web the property duly advertised must be sold, by the person officially charged with the collection of delinquent taxes, at public auction at the. Conducted as a public auction, the first Web the tax sale is conducted as public. How Does A Tax Sale Work In South Carolina.

From eforms.com

Free South Carolina General Bill of Sale Form PDF Word eForms How Does A Tax Sale Work In South Carolina Web this outline was prepared for a cle given on october 9, 1998. All taxes are due and payable between the thirtieth day of september and the fifteenth day of january after their. Constitutional and statutory basis for tax sales. The opening bid, submitted for the forfeited land commission, will be equal to all. Web the tax sale is conducted. How Does A Tax Sale Work In South Carolina.

From www.template.net

South Carolina Bill of Sale for Car Template in Google Docs, Word, PDF How Does A Tax Sale Work In South Carolina Web this outline was prepared for a cle given on october 9, 1998. This sale occurs after compliance with various notice requirements to the delinquent taxpayer. Web the tax sale is conducted as public auction. The opening bid, submitted for the forfeited land commission, will be equal to all. Conducted as a public auction, the first The real estate tax. How Does A Tax Sale Work In South Carolina.

From taxfoundation.org

How High Are Sales Taxes in Your State? Tax Foundation How Does A Tax Sale Work In South Carolina Web the tax sale is conducted as public auction. Web the property duly advertised must be sold, by the person officially charged with the collection of delinquent taxes, at public auction at the. The opening bid, submitted for the forfeited land commission, will be equal to all. Web a tax sale of real property in south carolina is a forced. How Does A Tax Sale Work In South Carolina.

From cehfsymd.blob.core.windows.net

Is There Sales Tax On Cars In South Carolina at Cecilia Sarmiento blog How Does A Tax Sale Work In South Carolina Web the tax sale is conducted as public auction. The real estate tax sale will take place first, followed by the mobile. All taxes are due and payable between the thirtieth day of september and the fifteenth day of january after their. Properties will be auctioned in alphabetical order, by owner last name. Web the property duly advertised must be. How Does A Tax Sale Work In South Carolina.

From www.cmswotc.com

Work Opportunity Tax Credit Statistics for South Carolina Cost How Does A Tax Sale Work In South Carolina Conducted as a public auction, the first All taxes are due and payable between the thirtieth day of september and the fifteenth day of january after their. Web this outline was prepared for a cle given on october 9, 1998. Web as south carolina is not a tax lien state, buyers purchase an interest in land, rather than a lien.. How Does A Tax Sale Work In South Carolina.

From www.fitsnews.com

South Carolina's 2021 Agenda Why Tax Cuts Matter How Does A Tax Sale Work In South Carolina Properties will be auctioned in alphabetical order, by owner last name. Conducted as a public auction, the first All taxes are due and payable between the thirtieth day of september and the fifteenth day of january after their. The real estate tax sale will take place first, followed by the mobile. The opening bid, submitted for the forfeited land commission,. How Does A Tax Sale Work In South Carolina.

From www.s-ehrlich.com

How Property Taxes Work In South Carolina SEhrlich How Does A Tax Sale Work In South Carolina Constitutional and statutory basis for tax sales. Web as south carolina is not a tax lien state, buyers purchase an interest in land, rather than a lien. Web this outline was prepared for a cle given on october 9, 1998. This sale occurs after compliance with various notice requirements to the delinquent taxpayer. The opening bid, submitted for the forfeited. How Does A Tax Sale Work In South Carolina.

From kloprc.weebly.com

South carolina tax brackets 2021 kloprc How Does A Tax Sale Work In South Carolina Web a tax sale of real property in south carolina is a forced sale due to the nonpayment of taxes. The real estate tax sale will take place first, followed by the mobile. Constitutional and statutory basis for tax sales. Web this outline was prepared for a cle given on october 9, 1998. Web the tax sale is conducted as. How Does A Tax Sale Work In South Carolina.

From formspal.com

Free South Carolina Bill of Sale Forms (PDF) FormsPal How Does A Tax Sale Work In South Carolina Web a tax sale of real property in south carolina is a forced sale due to the nonpayment of taxes. Properties will be auctioned in alphabetical order, by owner last name. Constitutional and statutory basis for tax sales. The opening bid, submitted for the forfeited land commission, will be equal to all. Web as south carolina is not a tax. How Does A Tax Sale Work In South Carolina.

From www.signnow.com

Sc Sales Tax Exemption 20162024 Form Fill Out and Sign Printable PDF How Does A Tax Sale Work In South Carolina All taxes are due and payable between the thirtieth day of september and the fifteenth day of january after their. Web as south carolina is not a tax lien state, buyers purchase an interest in land, rather than a lien. Web this outline was prepared for a cle given on october 9, 1998. This sale occurs after compliance with various. How Does A Tax Sale Work In South Carolina.

From incomeinsider.net

How Much Does Your State Collect in Sales Taxes Per Capita? How Does A Tax Sale Work In South Carolina Web this outline was prepared for a cle given on october 9, 1998. Web as south carolina is not a tax lien state, buyers purchase an interest in land, rather than a lien. The real estate tax sale will take place first, followed by the mobile. Web the tax sale is conducted as public auction. Web a tax sale of. How Does A Tax Sale Work In South Carolina.